DEBT LIMIT DEBATE: Take Note Of Impoverished Nations Being Squeezed By Chinese Debt

The bill is coming due on impoverished nations on brink of collapse

It’s easy to say we can just borrow more money. But what happens when you’ve tapped out your credit and you are drowning in debt?

Let’s not forget that the reason we now find ourselves in a national debate about the Debt Limit is because we have run up the percentage of our national debt to levels never seen before in our history.

That even includes when we were putting everything on the national credit card back in WWII.

Will this presidential election be the most important in American history?

The Biden administration uses euphemisms like a ‘clean debt ceiling’. What they really mean is they want McCarthy to raise the debt limit on the metaphorical national credit card, without any curbs on the runaway spending that got us into this mess in the first place.

But we have examples — playing out in real time — serving as a dark warning of what happens if a country gets in over its head in debt.

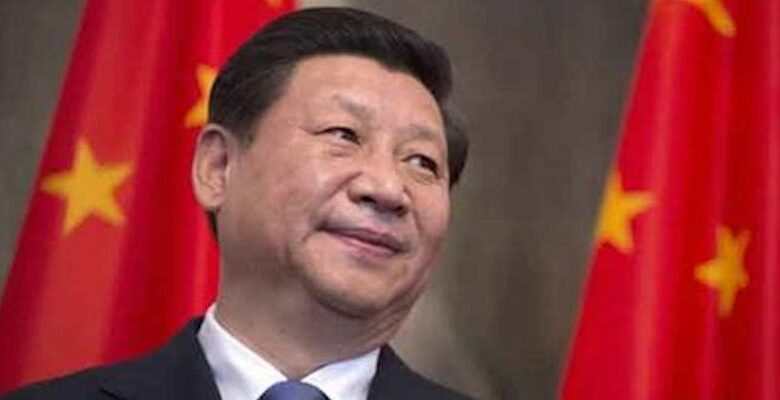

Poor nations that relied on freebies from China are now finding themselves between a rock and a hard place.

A dozen poor countries are facing economic instability and even collapse under the weight of hundreds of billions of dollars in foreign loans, much of them from the world’s biggest and most unforgiving government lender, China.

An Associated Press analysis of a dozen countries most indebted to China — including Pakistan, Kenya, Zambia, Laos and Mongolia — found paying back that debt is consuming an ever-greater amount of the tax revenue needed to keep schools open, provide electricity and pay for food and fuel. And it’s draining foreign currency reserves these countries use to pay interest on those loans, leaving some with just months before that money is gone.

[…]

Countries in AP’s analysis had as much as 50% of their foreign loans from China and most were devoting more than a third of government revenue to paying off foreign debt. Two of them, Zambia and Sri Lanka, have already gone into default, unable to make even interest payments on loans financing the construction of ports, mines and power plants.

In Pakistan, millions of textile workers have been laid off because the country has too much foreign debt and can’t afford to keep the electricity on and machines running. — AP

Further complicating matters is the fact that Chinese loans are cloaked in secrecy and include clauses that make them legally first-in-line for any debt repayment. This chases away any international investors who might take a chance at loaning them money, because there is no way of assessing the risk involved in that loan.

This makes countries even more dependent on China. And when countries get in over their head and default? Don’t come looking for merciful terms. The CCP plays hardball.

“In a lot of the world, the clock has hit midnight,” said Harvard economist Ken Rogoff. “ China has moved in and left this geopolitical instability that could have long-lasting effects.” –AP

Before we think about that as an ‘over there’ problem, stop and think about how integrated the world is… and about what happens to otherwise stable countries when ordinary people start missing meals.

And did you happen to notice at least one of those countries already on the bubble was part of the nuclear club? Or did you not notice Pakistan on the list the first time you read through it?

If you thought the pandemic caused unexpected supply chain surprises, what do you suppose happens here?

And one final consideration. The political upheaval that led to the conflict we saw in the 1940s? That was made possible, in part, because of the financial situation the world saw in the 1930s.